Aosóg Centres CLG

About AosÓg

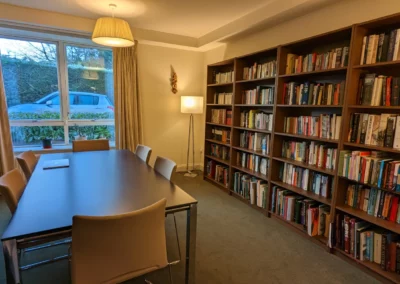

Our Centres

Aosóg Centres CLG owns, rents and manages buildings for use as university residences, study centres for university and school students, youth clubs and youth hostels for the advancement of education and the development of character according to Christian principles.

Aosóg Centres CLG is inspired by the message of St Josemaría Escrivá, founder of Opus Dei, that one can find God in the ordinary activities of daily life.

Castleville Study Centre

Limerick

Our structure

What defines us

Not-for-profit

These centres are charitable and not-for-profit. They depend on support from patrons, friends and parents from all over Ireland.

Catholic ethos

Organisation

Aosóg Centres CLG is registered in Ireland (no. 87823) and is a registered charity (CHY 6348 and RCN 20011352)

Where

Registered Address:

6 Clare Street, Dublin 2, Ireland.

Postcode: D02 EF82

“Heaven and earth seem to merge, my daughters and sons, on the horizon.

But where they really meet is in your hearts, when you strive for holiness in your everyday lives.”

St. Josemaría Escrivá

from the homily: Passionately Loving the World,

8 October 1967

Information on Tax Relief

Eligibility

Donations from individuals or companies to eligible charities can qualify for tax relief. Aosóg Centres CLG is eligible for this tax relief.

Donation method

To qualify, the total donations from any one individual or company in a year must be €250 or more, up to a limit of €1,000,000. Donations can be made by cheque, electronic fund transfers or Bankers Order. [pdf printable].

The nature of the Tax Relief

The nature of the tax relief will vary depending on the tax status of the donor, whether they are a PAYE employee, a self-employed person, or a Company.

Donations from persons

For a PAYE employee or self-employed person who has donated €250 or more in a calendar year, tax relief can be claimed by Aosóg through the Revenue’s Charitable Donations Scheme. At the end of a calendar year, Aosóg asks each donor to complete a CHY3 form (the Revenue’s tax-back form). This form is valid for a five-year period, during which any donations of at least €250 in any of those years, can be submitted by Aosóg to get the tax relief. For example, if a donor donates €250 to Aosóg in 2023 and completes a CHY3 form at the end of the year, Aosóg will receive the donation of €250 and potentially another €112.32 from Revenue in relation to that same donation. So, a donation of €250 from the individual becomes €362.32 for Aosóg through the Charitable Donations Scheme.

Donations from companies

The company donating can claim a deduction in its annual tax return.